27+ Online sales tax calculator

The process to use the Sales Tax Calculator is quite simple and straightforward. Addition to the original price.

Form 8621 Calculator Pay As You Go Form 8621 Calculator

Divide the tax rate by 100.

. Free sales tax calculator to lookup the sales tax rate and calculate sales tax by address or zip code in the US. Online sales tax calculator to find out sales tax by zip code in every state. Get the free Avalara guide for ecommerce sales tax compliance.

Sales tax is calculated by multiplying the. Sales tax is paid. By clicking Accept All Cookies you agree to.

Learn about compliance with a free guide from Avalara. The calculator will show you the total sales tax amount as well as the county city. This means that sales tax rates can be very different even in locations that are only a few miles from each other.

See the tax rate amount and beforeafter price of your product. Where Sales Tax is the dollar amount of sales tax paid Sales Tax Percent is the state sales tax as a percentage and Sales Tax Rate is the state sales tax as a decimal for calculations. Tax 203 tax value.

1 0075 1075. Counties cities and districts impose their own local taxes. To easily divide by 100 just move the decimal point two spaces to the left.

Use this free easy-to-use online Sales Tax calculator to estimate the amount of tax you will pay and keep you and your business organized. There is base sales tax by state. The SalesTaxHandbook Sales Tax Calculator is a free tool that will let you.

Enter the sales tax percentage. Find out the net price of a product. Amount Tax Inclusive.

Get the free Avalara guide for ecommerce sales tax compliance. Gross Amount including tax 10888. Tax 27 0075.

Enter the total amount that you wish to have calculated in order to determine tax on the sale. As an example the sales tax on an item is 10 of the total. You can use our Georgia Sales Tax Calculator to look up sales tax rates in Georgia by address zip code.

Find out the sales tax rate. In our example let us make it 4. How to calculate sales tax with our online sales tax calculator.

Sales tax is a tax that is paid to a tax authority for the sale of goods and services. A tax of 75 percent was added to the product to make it equal to 3008925. So divide 75 by 100 to get 0075.

For instance in Palm Springs California the total. Net Amount excluding tax 10000. Add one to the percentage.

Sales taxes can also be referred to as retail excise or privilege taxes depending on the state. Fill in price either with or without sales tax. Ad Ecommerce sales tax can be tricky.

The steps are as beneath. Learn about compliance with a free guide from Avalara. Use this calculator the find the amount paid on sales tax on an item and the total amount of the purchase.

Ad Ecommerce sales tax can be tricky. United States Sales Tax calculator. Simply put sales tax is a percentage of the price of an itemshare that is paid to a governing body in.

Tax Rate Includes Tax. Sales Tax Calculator. Initially you can provide the details like Before Tax Price Tax Rate or simply choose.

Now find the tax value by multiplying tax rate by the before tax price.

Form 8621 Calculator Pay As You Go Form 8621 Calculator

Form 8621 Calculator Pay As You Go Form 8621 Calculator

Vat Calculator

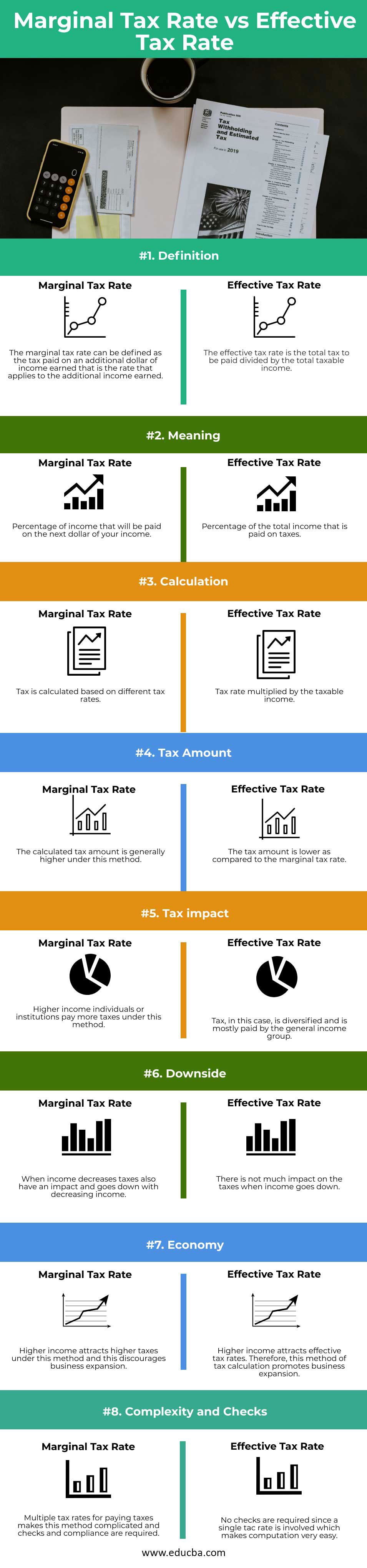

Marginal Vs Effective Tax Rate Top 8 Differences To Learn Infographics

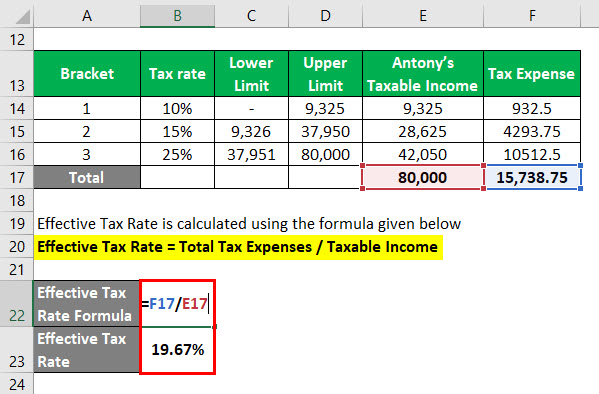

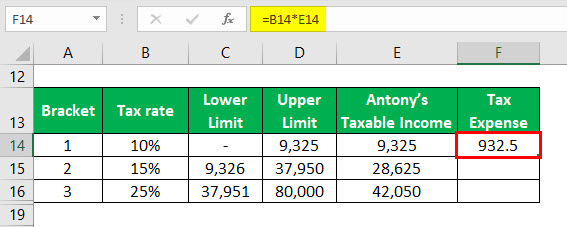

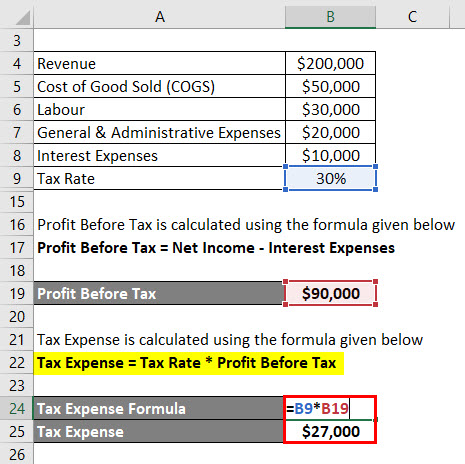

Effective Tax Rate Formula Calculator Excel Template

Tax Shield Formula How To Calculate Tax Shield With Example

Solved Please See Attachments For Details Course Hero

Effective Tax Rate Formula Calculator Excel Template

Tax Shield Formula How To Calculate Tax Shield With Example

Vat Calculator

Nopat Formula How To Calculate Nopat Excel Template

Effective Tax Rate Formula Calculator Excel Template

Solved Please See Attachments For Details Course Hero

Vat Calculator

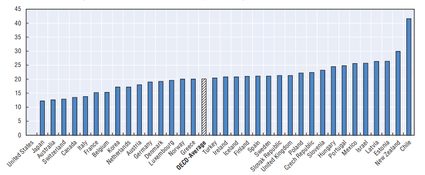

Sales Tax Effects Of Sales Tax Objectives Of Sales Tax

Marginal Vs Effective Tax Rate Top 8 Differences To Learn Infographics

Vat Calculator